Uniswap 3.0

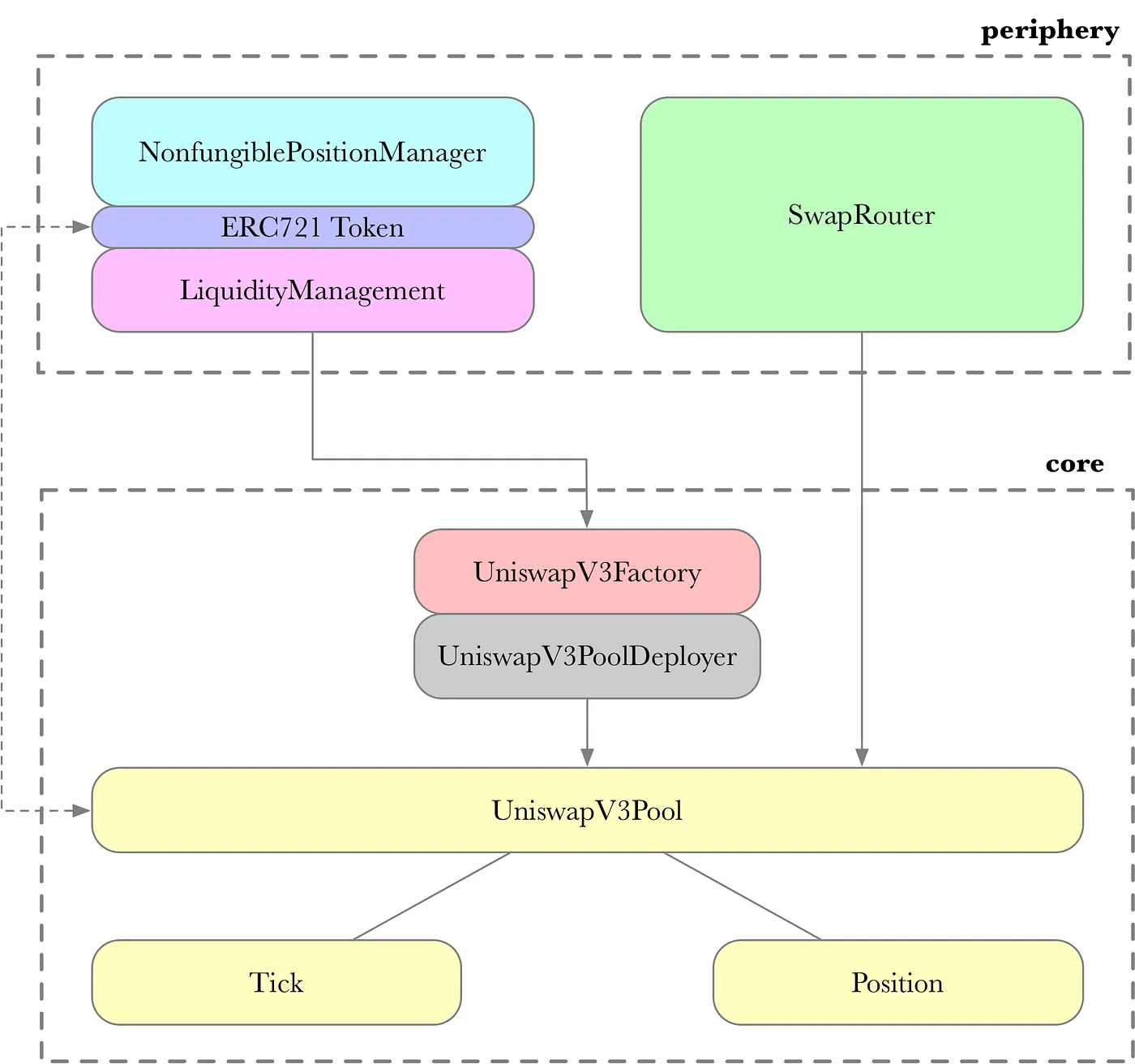

1) Core-periphery pattern

- The core-periphery pattern refers to a structural arrangement observed in various systems, where a central core interacts more intensively among its components compared to its outer periphery.

2) Core contracts

2.1) Uniswap Pool

- UniswapV3Pool is set up and managed by UniswapV3PoolDeployer.

- UniswapV3Pool is the core logic, and it manages Tick and Position, implements liuquidity management,and the swap functionality in a transaction pool.

- In each Pool, Position becomes an ERC721 Token. That is to say, each Position has its independent ERC721 Token ID

2.2) Uniswap Periphery

Periphery functions can also break down into two parts:

2.2a) Position management:

- NonfungiblePositionManager is in charge of creation of transaction pool and addtion/removal of liquidity.

2.2b) Swap router management:

- SwapRouter is swap router management. UniswapV3Factory is the unified interface of the transaction pool UniswapV3Pool.

Core contracts

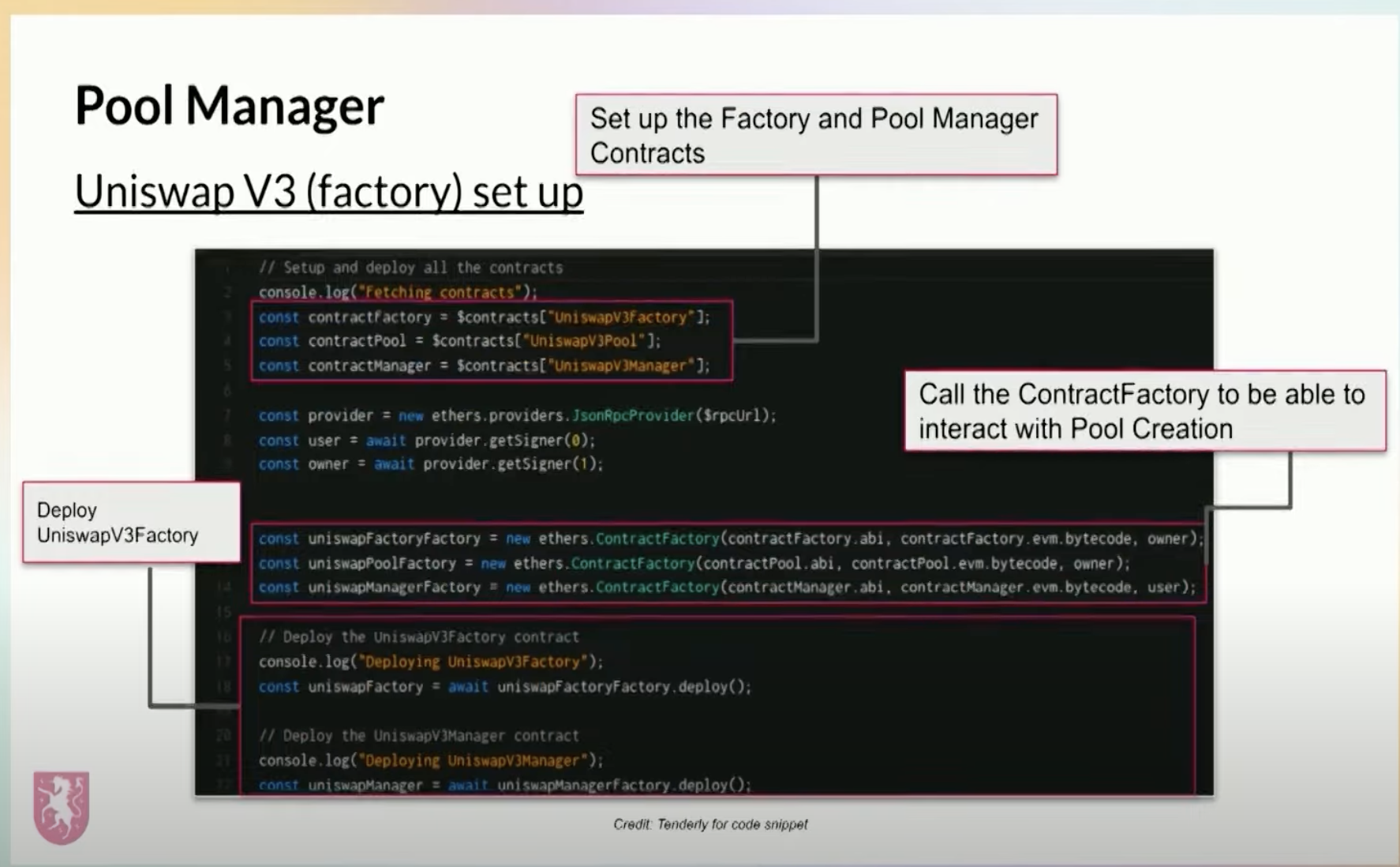

UniswapV3Factory Contract Functionality

Imports:

- Depends on interfaces and contracts like IUniswapV3Factory, UniswapV3PoolDeployer, NoDelegateCall, and UniswapV3Pool.

Contract Inheritance:

- Inherits from IUniswapV3Factory, UniswapV3PoolDeployer, and NoDelegateCall, thereby implementing functions from IUniswapV3Factory and gaining functionalities of the other contracts.

State Variables:

- owner: Stores the contract owner's address.

- feeAmountTickSpacing: Associates fee amounts with tick spacings.

- getPool: Maps token addresses and fee amounts to their corresponding pool addresses.

Constructor:

- Sets initial owner to deploying address.

- Initializes feeAmountTickSpacing with fee levels and corresponding tick spacings.

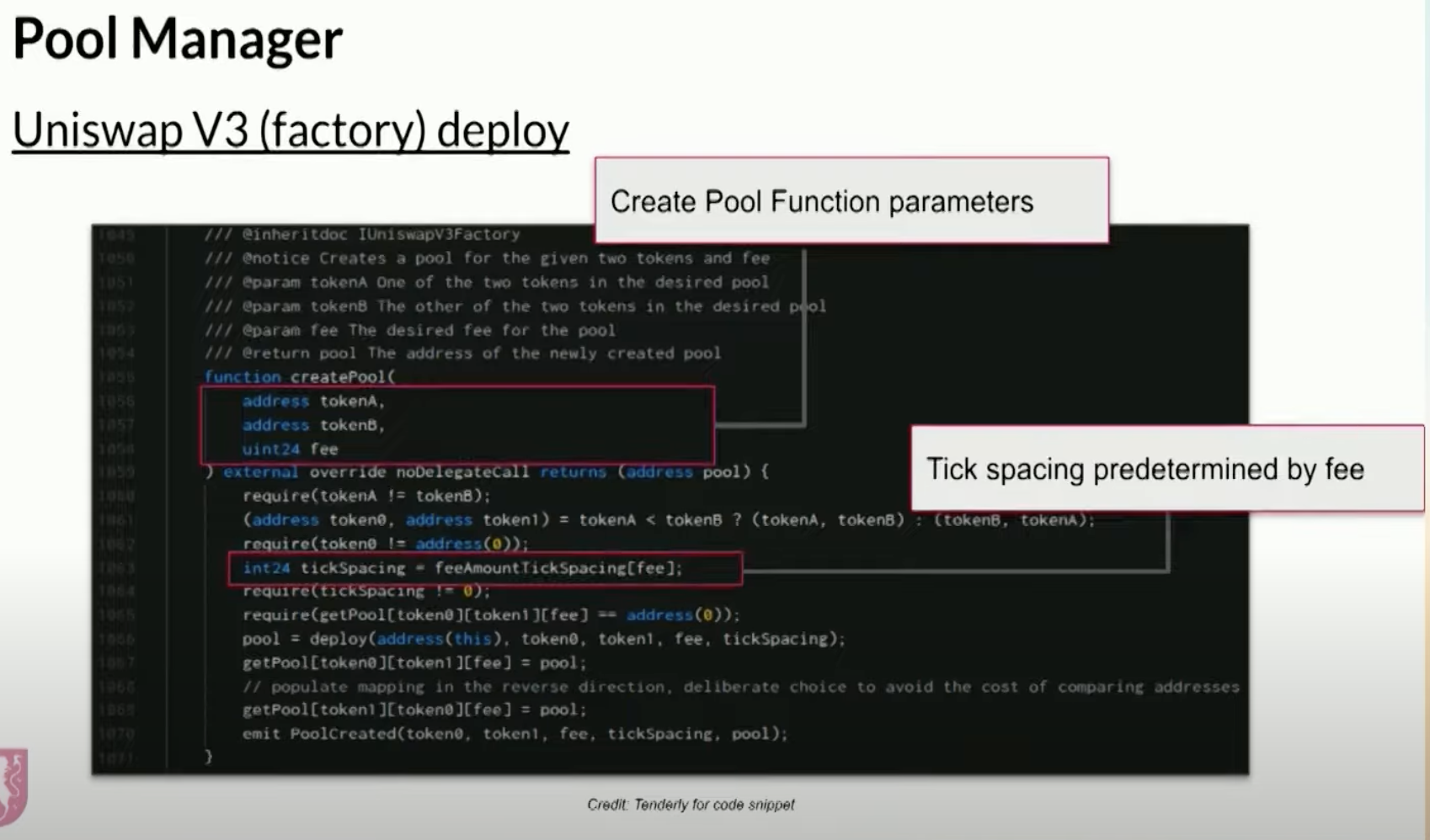

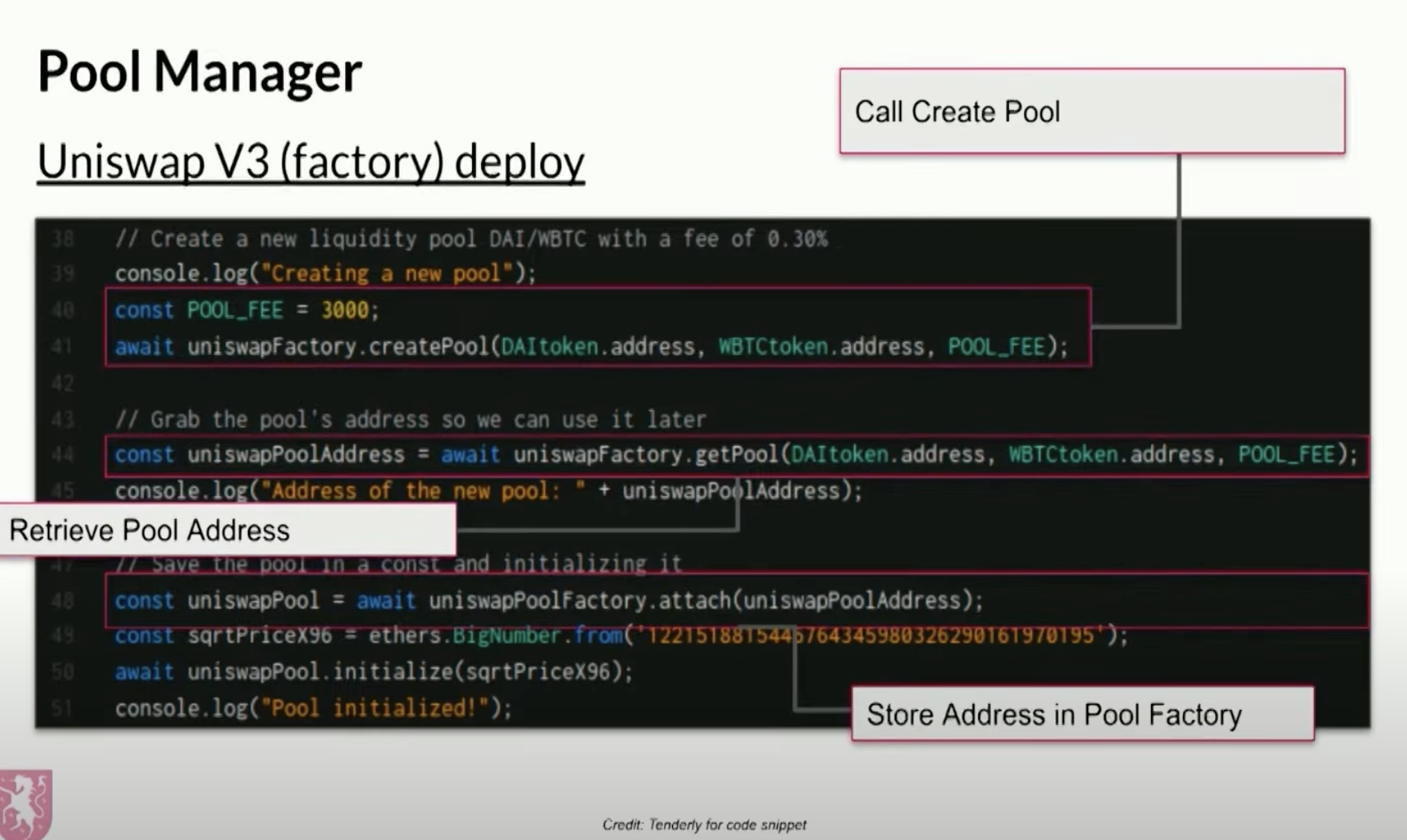

createPool Function:

- Creates a new Uniswap V3 pool for token pairs with a specified fee, performing multiple validity checks.

- Deploys the pool and updates the getPool mapping.

setOwner Function:

- Allows the current owner to transfer ownership of the contract.

enableFeeAmount Function:

- Enables a new fee amount with corresponding tick spacing, following specific constraints on values.

Potential Security Flaws:

- Centralization Risk: Owner's special privileges pose a centralization risk if the owner's private key is compromised.

- No Upgradeability: Contract lacks upgradability, requiring a new deployment for fixes or enhancements.

- No Time Locks or Multi-Sig: Absence of time locks or multi-sig for owner actions lacks community input or delay.

- Delegate Call Protection: createPool function is protected against delegatecall but other functions lack this safeguard.

Overall, while following standard practices for a Uniswap V3 factory contract, centralization risks due to owner privileges are notable. Ensuring a trusted owner or employing secure governance is crucial.

State-Changing Functions in UniswapV3Factory

constructor():

- Initializes the contract by setting the deploying address as the owner.

- Sets initial values for feeAmountTickSpacing.

createPool(address tokenA, address tokenB, uint24 fee):

- Creates a new pool for the specified token pair and fee.

- Updates the getPool mapping with the new pool's address.

- Emits a PoolCreated event.

setOwner(address _owner):

- Changes the contract owner to the provided _owner address.

- Emits an OwnerChanged event.

enableFeeAmount(uint24 fee, int24 tickSpacing):

- Enables a new fee amount with corresponding tick spacing.

- Updates the feeAmountTickSpacing mapping.

- Emits a FeeAmountEnabled event.

User fund Management

It does not directly manage user funds. Instead, it creates and manages the smart contracts (pools) where user funds will be managed.

Pool Creation

- createPool Function: Deploys a new UniswapV3Pool contract for user fund management.

- Functionality: Users deposit funds in these pool contracts.

Liquidity Provision

- Interaction: Liquidity providers deposit token pairs in individual UniswapV3Pool contracts.

- Process: Tokens are locked within the pool contracts as liquidity.

Swapping

- Trader Interaction: Traders conduct token swaps through pool contracts.

- Execution: Reserves in pool contracts adjust to reflect trades, facilitating token transfer between traders and pools.

Liquidity Withdrawal

- Withdrawal by Providers: Liquidity providers withdraw deposited liquidity and accrued fees.

- Process: Pool contracts manage fund withdrawal based on the liquidity provided.

Fee Management

- UniswapV3Factory: Manages protocol fees by configuring fee tiers and tick spacings.

- Fee Collection: Individual pool contracts handle actual fee collection and distribution.

In essence, the Uniswap V3 ecosystem operates by creating and managing pool contracts where users handle their funds. These contracts facilitate liquidity provision, swapping, withdrawal, while the factory contract oversees fee configurations but leaves fee collection to the individual pool contracts.

UniswapV3Pool Contract Overview

Contract Initialization

- Constructor: Initializes the pool with parameters from IUniswapV3PoolDeployer.

- Initialization Parameters: Sets factory address, two tokens, fee, tick spacing, and calculates maxLiquidityPerTick.

State Variables

- Variables: Contains factory address, token addresses, fee, tick spacing, max liquidity per tick, mappings for ticks, positions, and observations.

Modifiers

- lock Modifier: Prevents re-entry into functions, critical for avoiding reentrancy attacks.

- onlyFactoryOwner Modifier: Restricts certain functions to be called solely by the Uniswap V3 factory contract owner.

Liquidity Management

- Functions: mint, burn, collect, flash allow liquidity addition/removal, fee collection, flash swaps.

- Protection: Utilizes lock modifier to prevent reentrancy attacks.

Swapping

- swap Function: Enables token0 and token1 trading within specified price limits, updating the pool's state.

Observations

- Data Tracking: Maintains array of observations for time-weighted average prices and data points.

- Functions: observe, snapshotCumulativesInside provide relevant data.

Protocol Fees

- Fee Handling: Allows setting and collection of protocol fees by the factory owner.

Security Considerations

- lock Modifier: Crucial in preventing reentrancy attacks.

- SafeMath Libraries: Prevents arithmetic overflows/underflows.

- noDelegateCall Modifier: Prevents delegate call attacks.

- Valid Tick Checks: Ensures tick inputs are valid within allowed ranges.

- Staticcall Usage: Safely interacts with external contracts, checks return values for safety.

- Single Initialization: Prevents re-initialization attacks with the initialize function.

Overall, the UniswapV3Pool contract is intricate and vital for Uniswap V3's operations. Thorough security audits and testing are imperative due to the contract's complexity and its handling of substantial value in Uniswap pools.

State Modifying

In the provided Solidity code for the UniswapV3Pool contract, the following functions can change the state of the contract:

increaseObservationCardinalityNext initialize mint collect burn swap flash setFeeProtocol collectProtocol These functions either modify the contract's storage variables or emit events that log state changes on the Ethereum blockchain. Functions that are marked with the lock modifier also ensure that reentrancy is prevented during state-changing operations.

User Fund Management in UniswapV3Pool Contract

Liquidity Management

- Mint Function: Adds liquidity to the pool, creating/updating a liquidity position with token0/token1 deposits within a price tick range.

- Burn Function: Removes liquidity from a position, entitling the user to pool's token0/token1 based on the removed liquidity.

Swaps

- Swap Function: Enables token0/token1 swaps considering current pool state and specified price limits.

- Functionality: Transfers tokens ensuring correct amounts for users.

Fee Collection

- Swap Fees: Portion of each swap is taken as a fee, distributed proportionally to liquidity providers based on their share.

- Collect Function: Allows liquidity providers to retrieve accumulated token0/token1 fees.

Flash Swaps

- Flash Function: Permits borrowing token0/token1 from the pool with a repayment plus fee within the same transaction.

- Functionality: Enables arbitrage or operations without upfront capital, provided loan and fee are repaid in the transaction.

Protocol Fees

- setFeeProtocol Function: Adjusts a separate protocol fee on swaps, modifiable by the factory owner.

- collectProtocol Function: Enables factory owner to withdraw accumulated protocol fees.

Reentrancy Protection

- lock Modifier: Prevents reentrancy attacks during state-changing functions, disallowing external calls.

Balance Checks

- Pre and Post Calls: Ensures correct token transfer by performing balance checks before and after external calls.

Safe Transfers

- TransferHelper Library: Safely transfers ERC20 tokens to/from the contract, handling potential token transfer errors.

Overall, UniswapV3Pool contract manages user funds through intricate smart contract logic governing liquidity provision, swaps, fee accrual, while implementing robust protection measures against unauthorized access or reentrancy attacks. The contract's state and balances accurately reflect these operations.

UniswapV3PoolDeployer Contract Overview

Contract Information

- License & Compiler Version: Begins with a license identifier and specifies Solidity compiler version 0.7.6.

- Imports: Imports IUniswapV3PoolDeployer interface and UniswapV3Pool contract.

Struct and Variables

- Parameters Struct: Holds necessary deployment parameters: factory address, token0 & token1 addresses, fee rate for swaps, and tickSpacing.

- Public Variable: Declares public variable parameters of type Parameters.

Deploy Function

- Internal Function: Sets parameters, deploys UniswapV3Pool contract using create2 opcode with a computed salt based on token addresses and fee.

- Cleanup: Deletes parameters struct to reset storage slot after deployment.

Potential Security Flaws

- Access Control: Internal deploy function might be called by unauthorized contracts if not properly secured.

- Storage Clearance: Deletion of parameters intended for resetting storage after deployment could face issues if deletion fails or if reentrancy in UniswapV3Pool constructor interferes.

- Constructor Revert: Assumes UniswapV3Pool constructor won't revert. If it does, parameters wouldn't clear, potentially leading to storage leftovers.

- Compiler Version: Fixed compiler version (0.7.6) for consistent behavior; should be regularly reviewed for potential security updates.

- Deterministic Address: Uses create2 to make deployed pool address deterministic; input validation crucial to avoid collisions or unexpected behavior.

Overall, UniswapV3PoolDeployer seemingly deploys contracts deterministically using create2 based on specific parameters. Security largely relies on secure access control and proper constructor behavior in UniswapV3Pool.

State modifying

In the provided Solidity code, the deploy function changes the state of the contract. It does so by setting the parameters struct with the given inputs and then deploying a new UniswapV3Pool contract. After the deployment, it clears the parameters struct by using the delete keyword. These actions modify the contract's storage, which is a state-changing operation.

User Fund Management

Uniswap V3 Pool Deployer Contract Overview

Contract Information

- Role: Deploys new Uniswap V3 pool contracts.

- Fund Management: Doesn't directly manage user funds; instead, sets up parameters for new liquidity pools.

Responsibilities

- Deployment Setup: Establishes parameters (fee, tick spacing, token pairs) for creating new Uniswap V3 liquidity pools.

User Fund Management

- Handled By: Fund management tasks (depositing, withdrawing, swapping) are managed by the deployed UniswapV3Pool contract.

- Logic: UniswapV3Pool contract contains logic for liquidity provision, removal, swaps, and pool state management.

Functionality

- Deployment Only: Functions here solely focused on deploying Uniswap V3 pool contracts.

- No Direct Interaction: No functions directly interacting with user funds; management tasks performed by the deployed pool contracts.

Understanding User Fund Management

- Review Required: To comprehend user fund management, inspect UniswapV3Pool contract & associated contracts managing user interactions within the liquidity pool.

Periphery contracts

I. SWAP router

SwapRouter Contract Overview

Contract Information

- Role: Facilitates token swaps interacting with Uniswap V3 pools.

- Standard: Implements the ISwapRouter interface and inherits from several base contracts.

Functionalities

- Swap Intermediary: Acts as a mediator between users and Uniswap V3 pools for token swaps.

- Exact Input and Output Swaps: Facilitates swaps where input or output amounts are specified.

Security Considerations

- Solidity Version: Written for Solidity version 0.7.6.

- Inheritance: Inherits functionalities from multiple base contracts for validation, fee management, etc.

Core Components

- State Variables: Contains amountInCached to store input amount for exact output swaps temporarily.

- Initialization: Constructor initializes the contract with Uniswap V3 factory and WETH9 contract addresses.

- Pool Retrieval: getPool function computes the address of a Uniswap V3 pool for given token pairs and fee tiers.

Security Measures

- Reentrancy Safety: Follows checks-effects-interactions pattern to prevent reentrancy issues.

- Input Validation: Uses CallbackValidation.verifyCallback to authenticate correct pool callback.

- Overflow Protection: Utilizes SafeCast for uint256 to int256 conversions, mitigating overflows/underflows.

Considerations & Mitigations

- Access Control: Requires positive deltas in uniswapV3SwapCallback, mitigated by verifyCallback function.

- Price and Slippage Limits: Allows users to specify price bounds and slippage controls for swaps.

- Transient Storage: Uses amountInCached transiently, reset post-transaction to prevent stale state issues.

- Gas Optimization: Potential for optimizing repetitive code sections related to input and output swaps.

Conclusion

- Overall Structure: Well-structured and aligned with expected Uniswap V3 Swap Router functionalities.

- Testing & Auditing: Thorough testing, especially the swap callback mechanism, and professional auditing recommended before deployment to mainnet.

State-Changing Functions Overview

Function Details

- uniswapV3SwapCallback: Called during a swap by a Uniswap V3 pool, enabling token transfers and updates to amountInCached state variable.

- exactInputSingle: Initiates an exact input swap for a single pool, causing state changes via token transfers and pool contract interactions.

- exactInput: Performs a sequence of exact input swaps across multiple pools, leading to state changes through token transfers and pool interactions.

- exactOutputSingle: Triggers an exact output swap for a single pool, altering the state via token transfers and interactions with the pool contract.

- exactOutput: Executes an exact output swap, potentially across multiple pools, resulting in state changes through token transfers and pool interactions.

Additional Notes

These functions possess the ability to modify the contract's state. They might internally call other functions that interact with Uniswap V3 pools, perform token transfers, and further change the contract's state.

User Fund Management in SwapRouter Contract

Functionality Overview

- Swap Functions: Users trigger swaps using functions like exactInputSingle, exactInput, exactOutputSingle, and exactOutput. These require users to send tokens or ETH to execute the swap, handled by the contract.

- Callback Mechanism: Uniswap V3 pools call the uniswapV3SwapCallback during a swap. This function ensures correct input token transfer to the pool using the pay function.

- Token Transfers: The pay function facilitates token transfers between users and the pool, managing input and output token movements based on the swap type.

- Temporary State: The amountInCached variable stores input amounts temporarily for exact output swaps, resetting after swaps.

- Refunds: Excess tokens above the maximum authorized amount remain in the contract, requiring manual refund actions by users; the contract doesn't automatically refund excess tokens or ETH.

- ETH Handling: The contract handles wrapping and unwrapping ETH to WETH when involved in swaps, simplifying ETH transactions for users.

- Permissionless: User funds are only handled during swap execution; the contract doesn't retain funds after the swap transaction.

Considerations

- Users rely on the contract's correct fund handling during swaps, emphasizing the necessity for rigorous audits to identify and resolve potential vulnerabilities or bugs.

NonfungiblePositionDescriptor Contract Overview

Contract Overview

The NonfungiblePositionManager contract represents Uniswap V3 positions as non-fungible tokens (NFTs). It enables users to manage liquidity positions within Uniswap V3 pools, mint NFTs, increase or decrease liquidity, collect fees, and burn NFTs corresponding to liquidity positions.

Key Components

- Position Struct: Stores essential data about a Uniswap position, including pool details, tick range, liquidity, fee growth, and uncollected tokens.

- Mappings: _poolIds, _poolIdToPoolKey, _positions store pool IDs, pool keys, and position data.

- Variables: _nextId, _nextPoolId tracks the next available token ID and pool ID.

- mint: Function enabling liquidity provision to Uniswap V3 pools, minting corresponding NFTs.

- increaseLiquidity & decreaseLiquidity: Functions for adjusting liquidity within an NFT's represented position.

- collect & burn: Methods to collect fees and burn NFTs, respectively, removing the corresponding liquidity position.

Security Considerations & Recommendations

- Reentrancy: Review the contract for reentrancy vulnerabilities, especially in functions interacting with external contracts.

- Integer Checks: As Solidity 0.7.6 lacks built-in overflow/underflow checks, ensure robust checks to prevent arithmetic issues.

- Access Controls: Carefully review the isAuthorizedForToken modifier to properly restrict access.

- Contract Upgrades: Implement an upgradability pattern, like a proxy, if required.

- Gas Optimization: Review for gas optimizations, considering calldata usage and minimizing state changes.

- Front-Running: Protect against front-running attacks in functions reliant on external state changes.

- Correctness: Thoroughly test and verify the correctness of token minting, burning, and fee collection logic.

Audit & Review

A comprehensive audit should include thorough testing, formal verification, and detailed analysis of each function and interaction with Uniswap V3 contracts.

NonfungiblePositionManager Contract State Changes

In the provided Solidity code for the NonfungiblePositionManager contract, various functions are responsible for changing the contract's state:

State-Altering Functions

- mint: Creates a new NFT representing a Uniswap V3 position and updates liquidity, pool, and position data.

- increaseLiquidity: Increases liquidity for a given position, updating liquidity, fee growth, and related position data.

- decreaseLiquidity: Decreases liquidity for a given position, updating liquidity, tokens owed, and fee growth for the position.

- collect: Collects fees owed to a position and updates the position's tokens owed.

- burn: Burns an NFT representing a Uniswap V3 position after ensuring the position is cleared (liquidity and tokens owed are zero).

- _getAndIncrementNonce: Increments the nonce for a given token ID, primarily for permit functionality.

- _approv': Sets the operator for a given token ID, internally utilized by approve and setApprovalForAll from the ERC721 standard.

The constructor initializes the contract state upon deployment, setting the _tokenDescriptor and other parameters.

Additional Consideration

- cachePoolKey: Although a private function, caches a pool key, changing the state. It's internally used by other state-changing functions like mint.

These functions orchestrate critical state changes within the contract, from minting new NFTs to managing liquidity positions and permits. Each function alters specific contract data, playing a crucial role in maintaining and updating Uniswap V3 position information.

NonfungibleTokenPositionDescriptor Contract Overview

Contract Overview

The NonfungibleTokenPositionDescriptor contract is intended to describe NFT token positions, particularly for Uniswap V3 liquidity provider (LP) positions. It generates a data URI in JSON metadata format that represents these positions.

Functionality Breakdown

- Constants: Defines addresses for well-known ERC20 tokens like DAI, USDC, USDT, TBTC, WBTC.

- State Variables: Includes immutable variables for WETH9 (wrapped Ether) and native currency label bytes.

- Constructor: Sets values for WETH9 and nativeCurrencyLabelBytes.

- nativeCurrencyLabel Function: Converts nativeCurrencyLabelBytes into a string.

- tokenURI Function: Retrieves position info, computes Uniswap V3 pool address, determines token order, and constructs the token URI.

- flipRatio Function: Decides token order based on priority defined in flipRatio and tokenRatioPriority.

- tokenRatioPriority Function: Assigns token priority based on predefined rules.

Security Considerations & Recommendations

- Hardcoded Addresses: The contract hardcodes token addresses, limiting flexibility if deployed on different networks or if tokens are upgraded.

- Centralization Risk: Relies on external contracts (positionManager, pool, NFTDescriptor) with potential vulnerabilities or upgradability risks.

- Immutability: Immutable variables mean redeployment is necessary for changes to WETH9 or nativeCurrencyLabelBytes.

- Data Validation: Lacks validation for returned data from positionManager, posing risks if compromised or providing incorrect data.

- Interface Compliance: Assumes token compliance with IERC20Metadata; non-compliance could lead to reverts.

- Upgradability & Maintenance: Lack of upgradability may necessitate contract redeployment for updates or issues.

- Gas Optimization: Opportunity for gas optimization, especially in the nativeCurrencyLabel function.

Contract Review & Maintenance

Verify security of external contracts and interfaces. Consider the impact of hardcoded values and lack of upgradability on flexibility and longevity.

NonfungibleTokenPositionDescriptor Contract - State Immutable

In the provided Solidity code for the NonfungibleTokenPositionDescriptor contract, no functions are responsible for altering the contract's state. All functions are either view or pure, signifying that they solely read data from the blockchain without modifying it.

State-Immutable Functions

- View Functions: Retrieve information or compute values without changing the contract's state.

- Pure Functions: Perform calculations or return values based on provided inputs but don't alter contract state.

Constructor

The constructor initializes the contract's immutable state variables 'WETH9' and 'nativeCurrencyLabelBytes' during deployment. Once deployed, these values cannot be modified by any function within the contract.

This contract focuses on providing a descriptive interface for Uniswap V3 liquidity positions without any capability to alter or update its state post-deployment. It solely serves to provide metadata about the positions and remains static in terms of state changes.

Base contracts

- Liquidity Management

LiquidityManagement Contract Overview

The provided Solidity code defines an abstract contract named 'LiquidityManagement', intended for managing liquidity within Uniswap V3 pools. It inherits functionality from 'IUniswapV3MintCallback', 'PeripheryImmutableState', and 'PeripheryPayments', offering functions related to adding liquidity and handling mint callbacks.

Key Components

-

MintCallbackData Struct: Holds pool key (token addresses and fee tier) and payer address.

-

uniswapV3MintCallback: Called by the Uniswap V3 pool during liquidity addition. Validates callback from a valid Uniswap V3 pool using 'verifyCallback' from 'CallbackValidation'.

- Security Consideration: Ensures callback legitimacy, preventing unauthorized callbacks.

-

AddLiquidityParams Struct: Stores parameters to add liquidity to a Uniswap V3 pool.

-

addLiquidity: Internally adds liquidity to a Uniswap V3 pool, calculates liquidity amount based on desired token amounts, and checks against minimum specified amounts to prevent slippage.

- Security Consideration: Implements slippage protection by reverting if received token amounts are less than minimums.

-

PoolAddress.computeAddress: Computes the Uniswap V3 pool address using the factory address and pool key.

-

LiquidityAmounts.getLiquidityForAmounts: Calculates the liquidity amount given desired token amounts and the current price range of the pool.

-

pool.mint: Mints liquidity in the Uniswap V3 pool. Requires recipient, price range ticks, liquidity amount, and encoded 'MintCallbackData'.

- Security Consideration: Sensitively interacts with the Uniswap V3 pool; ensure legitimacy and safeguard against exploitation.

Security Considerations & Recommendations

- Conduct thorough audits, especially for reentrancy attacks, parameter validation, and interactions with external contracts.

- Review imported contracts and libraries ('PeripheryPayments', 'PeripheryImmutableState', etc.) for potential vulnerabilities.

The provided contract exhibits standard practices for Uniswap V3 pool interaction but warrants comprehensive security assessments and auditing to ensure robustness against potential vulnerabilities or exploitation.

LiquidityManagement Contract - Managing Uniswap V3 Liquidity

The provided Solidity code defines an abstract contract named LiquidityManagement, responsible for managing liquidity in Uniswap V3 pools. Here's an overview and potential security considerations:

Key Components

-

MintCallbackData Struct: Stores pool key and payer's address for mint callbacks.

-

uniswapV3MintCallback Function: Verifies callback legitimacy during liquidity addition from Uniswap V3 pool to prevent unauthorized callbacks.

-

AddLiquidityParams Struct: Holds parameters for adding liquidity to a Uniswap V3 pool.

-

addLiquidity Function: Internally adds liquidity to a Uniswap V3 pool by computing the pool address, calculating liquidity based on token0 and token1 amounts, and performs a 'mint' function call on the pool contract. It verifies received tokens against minimum amounts for protection against price slippage.

-

PoolAddress.computeAddress Function: Computes Uniswap V3 pool address using the factory address and pool key.

-

LiquidityAmounts.getLiquidityForAmounts Function: Calculates the mintable liquidity based on desired token0 and token1 amounts and the pool's current price range.

-

pool.mint Function: Executes the minting of liquidity in the Uniswap V3 pool. Requires recipient address, price range ticks, liquidity amount, and an encoded 'MintCallbackData' structure.

Security Considerations

-

Callback Verification: Ensures callbacks originate from legitimate Uniswap V3 pools via verifyCallback from CallbackValidation to prevent unauthorized access.

-

Minimum Amount Protection: Protects against price slippage by reverting transactions if actual token amounts received are less than user-specified minimums.

-

External Contract Interaction: The mint function interacts externally with the Uniswap V3 pool. Ensuring the legitimacy of the pool contract and preventing exploitability is crucial.

This code adheres to standard practices for managing liquidity in Uniswap V3 pools. However, a comprehensive audit is essential to verify the contract's security, test for reentrancy attacks, validate input parameters, and ensure interactions only with trusted external contracts. Thorough review of imported libraries and contracts (PeripheryPayments, PeripheryImmutableState, etc.) is also recommended to mitigate potential vulnerabilities.

- Multi call

Multicall Contract - Efficient Function Batching

The provided Solidity code defines an abstract contract named Multicall, facilitating multiple function calls within a single transaction. Here's an overview and potential security considerations:

multicall Function Breakdown

- Input: Accepts an array of encoded function call data (bytes array).

- Execution: Iterates through the input data array, performing a delegatecall to execute each function call.

- Results: Stores the return data from each call in an array called results.

- Error Handling: Attempts to provide informative error messages if a 'delegatecall' fails. If error data is insufficient, reverts without a message.

- Return: Returns the 'results' array containing return data from each function call.

Potential Security Flaws

-

Reentrancy: Risk of reentrancy attacks if the contract state isn't properly managed. Presence of reentrancy guards isn't determinable without viewing the entire contract.

-

Delegatecall Risks: delegatecall executes code from other contracts, which can lead to unexpected behavior. It's crucial to avoid calling untrusted or unintended functions.

-

Error Handling: Assumes the returned error data follows Solidity error encoding. Incorrectly formatted data might result in misleading or incorrect revert messages.

-

Gas Limit: delegatecall consumes gas; exceeding the block gas limit could cause transaction failures. Caution must be exercised when batching functions together.

-

Version Lock: Contract locked to Solidity 0.7.6 may miss future optimizations or security fixes. Keeping contracts up-to-date with the latest compiler versions is advisable.

-

ABI Decoder V2: Using pragma abicoder v2; in Solidity 0.7.6; however, newer versions have this feature enabled by default with more testing and bug fixes.

While the Multicall contract provides an efficient feature, cautious usage is vital to consider and mitigate potential security implications. Proper state management, avoiding untrusted contracts, and gas awareness are essential for safe function batching.

- ERC721Permit

- PoolInitializer

- SelfPermit

- PeripheryPayments

- PeripheryPaymentsWithFee

Note:

- You can get these images here:

- https://github.com/Nepalichhoro/big-hustler-defi-hub